Different home finance loan items may possibly present distinct pros and cons, and it’s important to investigate all available alternatives before making a choice.

? Leveraging the latest in lending tech, the chance of acquiring you a lender is : 0% We may have already got your file

Lenders make use of your Social Security range to confirm your id. Entering a legitimate number is crucial, as unverifiable info will result in rejection. What's going to my SSN be useful for?

We're sorry, but our system signifies a concern Together with the phone number and/or region code we been given. You appear to have entered .

Full Bio Pete Rathburn is a copy editor and simple fact-checker with know-how in economics and private finance and above twenty many years of experience inside the classroom.

You’ll also want to be sure that the house is reasonably priced to start with and that the vendor isn’t padding the cost to go over the buydown fees.

This makes certain that your SSN is protected towards unauthorized accessibility all through transmission and storage, safeguarding your personal data from cyber threats. How can I guard my SSN on-line?

Just Remember the fact that the cardboard performs greatest when you can pay off your harmony within that introductory time period.

You can even buy a three-two-one buydown for a consumer when you consider out a house loan with sure lenders. Get the proper house loan from a trusted lender. No matter whether you’re obtaining or refinancing, you could trust Churchill Home loan to assist you choose the best home loan having a locked-in rate. Join That has a click here Home finance loan Skilled

Your APR, regular monthly payment and loan volume count on your credit score record and creditworthiness. To choose out a loan, lenders will carry out a tough credit history inquiry and request a full application, which could have to have evidence of income, identity verification, proof of address plus more.

It's your past chance to Get the college student loans out of default so you can qualify for benefits like forgiveness.

After student loans are in default, they're frequently no more qualified for forgiveness packages as well as other federal pupil loan Positive aspects. The Contemporary Start out method features a means to so that you can get your loans again in superior standing and qualify for personal debt reduction.

By having to pay a reduce curiosity rate in the initial number of years, you can delight in diminished month-to-month mortgage loan payments, supplying you with extra fiscal overall flexibility over the early phases of homeownership.

Whether you are a primary-time home customer, trying to purchase a second dwelling or an financial commitment home, step one is to know the property finance loan pre approval course of action so that you can get yourself a pre acceptance letter. What's a pre-approval? The mortgage pre-acceptance method is where by a lender evaluations…

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Daniel Stern Then & Now!

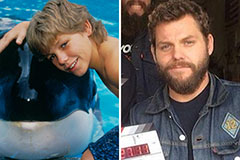

Daniel Stern Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Alisan Porter Then & Now!

Alisan Porter Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now!